straight life annuity death benefit

The reduced pension is calculated in the following manner. Income-focused annuity offers 25 Benefits Account Value Bonus as well as guaranteed lifetime income benefit and enhanced death benefit at no fee.

What Is A Straight Life Annuity Retirement Watch

For this reason income payments will typically be lower than the periodic.

. This language means that if you put 10000 into an annuity with money on which youve already paid income tax a nonqualified annuity contract and. Death benefit Usually seen in a term-life or other life insurance policy it refers to the amount paid out by the insurer to the beneficiary if you or the person insured dies when the policy is still active. In no event shall.

It can be anyone from your spouse children to your parents. Subsidized Early Retirement Benefit - A benefit amount that is not reduced or is reduced less than the full actuarial amount for retirement before normal retirement age. The Survivor Benefit Plan SBP ensures a military retirees dependents receive a continuous lifetime annuity.

EstateShield 10 Fixed Index Annuity. Loss of life limb or sight within 90 days of the injury while employed. The plan is designed to protect your survivors.

Cash lump sums are taxed according to the retirement lump sum tax table as though they had. If an active member becomes disabled while working for a participating employer and has five 5 or more years of actual and reciprocal service with ATRS the member may apply. This benefit is provided for eligible employees by Hartford Insurance Company.

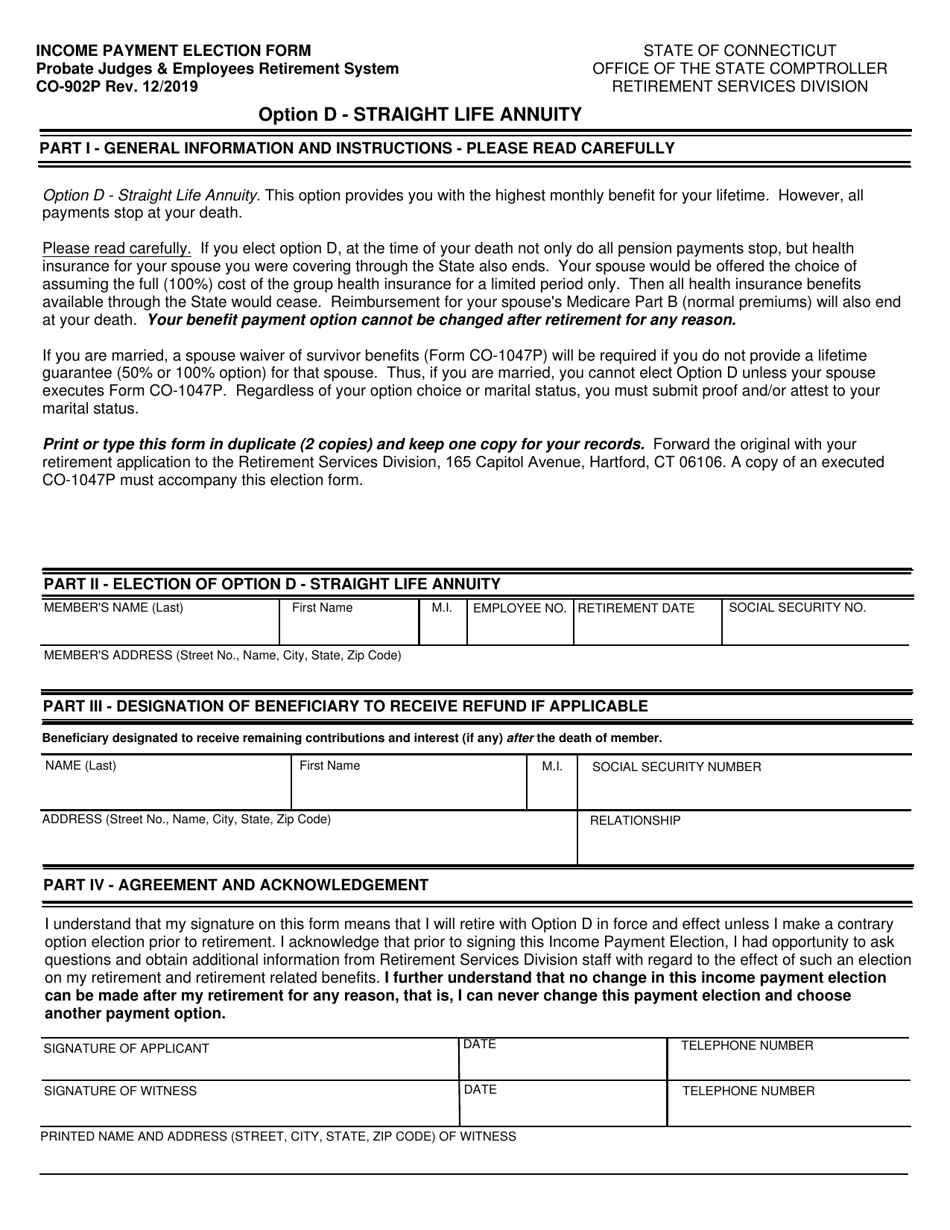

EstateShield 10 Fixed Index Annuity. Because the original annuity was reduced to offset the cost of a survivor benefit the ultimate benefit received by the retiree will be less than equivalent to the straight-life annuity. C The member may elect not to name a beneficiary and have his or her pre-retirement death benefit paid as a monthly annuity calculated as though the member had retired as of the date of his or her death and elected a Straight Life annuity to a minor child or children until the minor child or children attains age 21 or sooner marries or becomes emancipated.

The policy provides compensation to eligible employees that experience an accidental injury such as. What is a corridor in relation to a Universal Life insurance policy. The point in time when the policys.

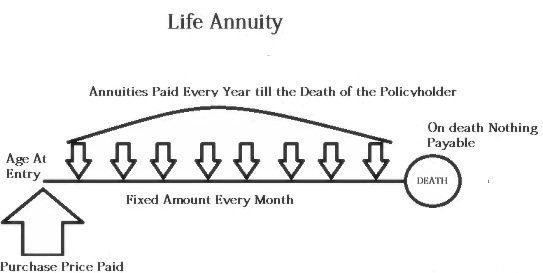

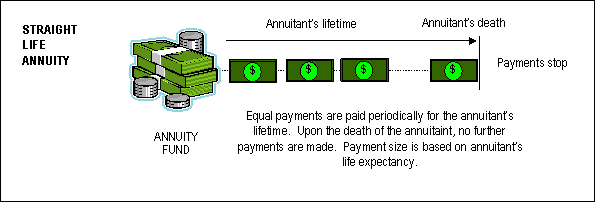

If you elect this type of life annuity and die before the end of the 5- 10- or 15-year time period you selected. Upon the death of the annuitant a period certain annuity will continue providing income payments to a beneficiary named in the contract. A straight-life annuity that provides you with fixed monthly benefit payments for your lifetime.

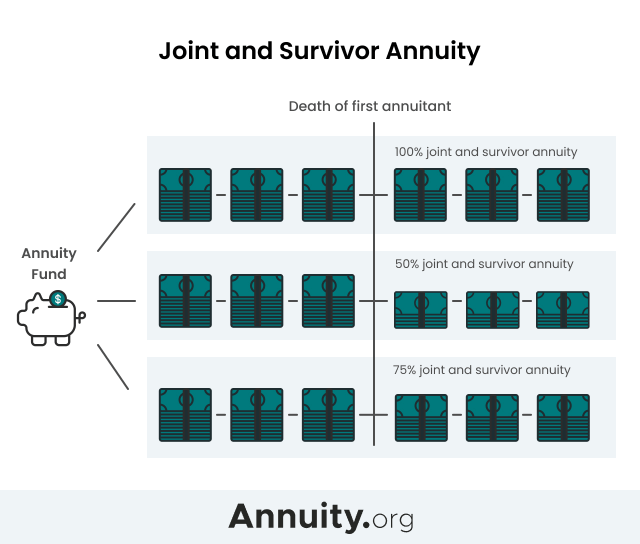

The SBP is an insurance plan that will pay your surviving spouse a monthly payment annuity to help make up for the loss of your retirement income. A period certain option added to a straight-life or joint and survivor annuity means the insurance company must continue making payments after the death of the annuitant. If an employee in a plan with joint-and-survivor protec-tion does not waive this coverage the employees pension is automatically reduced at retirement to allow for the spouses benefit.

Annual Retirement Benefit under Straight Life. Find answers to common SBP questions on our FAQ page. You can also include a period certain and name a beneficiary.

The beneficiaries who will receive a share of the death benefit can choose to receive their benefit either as a cash lump sum or as an annuity or as a combination of the two. The annuity income will be taxed in the hands of the recipient per the prevailing income tax tables. According to Haven Life a 35-year-old non-smoking male living in NY in good health will pay around a 30 monthly premium for a 20-year term life insurance policy with a 500000 death benefit.

This choice reduces the amount of each payment you would have received with a straight-life annuity or a life annuity with period certain. The amount of interest that has accumulated in the policys cash value D. A death benefit usually accompanies this type of annuity.

The gap between when a claim is filed and when the death benefit is received C. The gap between the total death benefit and the policys cash value B. Hartford will pay all or a portion of the principal sum as prescribed by the schedule of Losses and Benefits to the employee or.

In other words if an annuity owner dies before payouts begin the beneficiary will receive the current value of the contract. Members may elect one of four options for the ATRS retirement annuity. From there annuities can be divided into.

Beneficiary The person that youve nominated to receive your insurance pay-out in the event of your death. Spouse approximate the plans total payments in a straight-life annuity to a single person. This option allows the annuitant to receive the entire value.

For more information see Review of Annuity Options. A regular retirement benefit under the Straight Life annuity option is an amount equal to 2 of a members final average salary multiplied by the members years of service credit paid in equal monthly installments. Final average salary refers to the average of the 5 highest fiscal year salaries out of the last 15 fiscal years of contributing.

Straight-Life Annuity - An annuity that pays benefits typically monthly for one persons life with no survivor benefits after that person dies. The beneficiary would collect the death benefit if both annuitants die before the end of the period. No survivor benefit will be paid after your death.

Some plans anticipate the possibility that the retiree will outlive the spouse by offering a pop-up feature which increases the annuity payment upon the death of the spouse. A traditional fixed annuity also known as a guaranteed fixed annuity accumulates money at a fixed interest rate set at. Income-focused annuity offers 25 Benefits Account Value Bonus as well as guaranteed lifetime income benefit and enhanced death benefit at no fee.

See Your PBGC Benefit Options for more information. A 5-year 10-year or 15-year certain-and-continuous annuity that provides you with fixed monthly benefit payments for your lifetime.

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Annuity Payout Options Immediate Vs Deferred Annuities

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

Straight Life Annuity Providing Peace Of Mind In Your Retirement

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Form Co 902p Download Fillable Pdf Or Fill Online Income Payment Election Form Option D Straight Life Annuity Connecticut Templateroller

Joint And Survivor Annuity The Benefits And Disadvantages

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Period Certain Annuity What It Is Benefits And Drawbacks

Annuity Payout Options Immediate Vs Deferred Annuities

Annuity Beneficiaries Inherited Annuities Death

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity For Retirement Is It Right For You Paradigm Life